All Categories

Featured

Take Into Consideration Making use of the cent formula: DIME stands for Financial debt, Earnings, Mortgage, and Education and learning. Total your financial debts, home mortgage, and university expenses, plus your income for the variety of years your family requires protection (e.g., up until the children are out of your home), which's your coverage requirement. Some economic specialists determine the quantity you need utilizing the Human Life Value philosophy, which is your lifetime income potential what you're earning now, and what you expect to earn in the future.

One way to do that is to try to find companies with strong Economic toughness scores. what to do when your term life insurance is expiring. 8A company that underwrites its very own policies: Some firms can market plans from an additional insurer, and this can add an added layer if you wish to alter your policy or in the future when your household requires a payment

What Is Level Term Life Insurance

Some firms provide this on a year-to-year basis and while you can expect your prices to rise substantially, it might be worth it for your survivors. Another method to compare insurance coverage companies is by looking at online consumer evaluations. While these aren't likely to tell you a lot regarding a company's monetary stability, it can tell you how simple they are to function with, and whether insurance claims servicing is a problem.

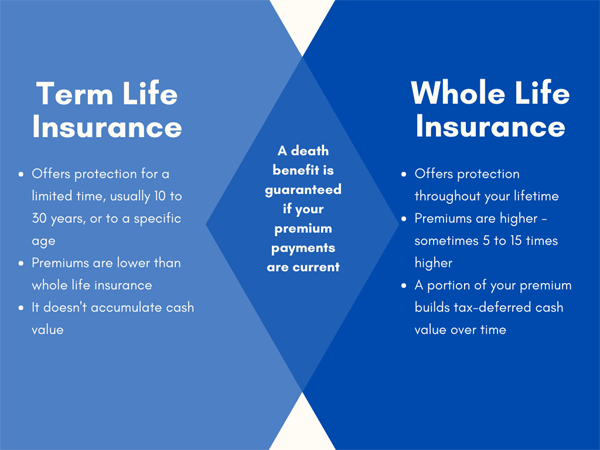

When you're more youthful, term life insurance policy can be a basic means to secure your liked ones. As life changes your economic priorities can as well, so you might desire to have entire life insurance policy for its life time coverage and added benefits that you can use while you're living. That's where a term conversion comes in - decreasing term life insurance quote.

Approval is assured no matter your wellness. The premiums won't enhance when they're established, yet they will certainly go up with age, so it's a good idea to secure them in early. Locate out even more regarding how a term conversion works.

1Term life insurance provides short-term security for a vital duration of time and is usually less pricey than permanent life insurance. level premium term life insurance policies xcel. 2Term conversion standards and limitations, such as timing, might apply; for instance, there might be a ten-year conversion privilege for some items and a five-year conversion advantage for others

3Rider Insured's Paid-Up Insurance Purchase Choice in New York. 4Not readily available in every state. There is a price to exercise this biker. Products and riders are readily available in authorized territories and names and attributes might differ. 5Dividends are not assured. Not all taking part plan proprietors are eligible for returns. For choose motorcyclists, the condition uses to the guaranteed.

Latest Posts

What Is Supplemental Term Life Insurance

The Combination Of Whole Life And Blank Term Insurance Is Referred To As A Family Income Policy

What Is A Direct Term Life Insurance Policy