All Categories

Featured

Consider Utilizing the dollar formula: cent represents Debt, Earnings, Home Mortgage, and Education. Total your debts, mortgage, and college expenses, plus your income for the number of years your household needs security (e.g., up until the children are out of the home), and that's your coverage demand. Some financial professionals calculate the amount you require utilizing the Human Life Value viewpoint, which is your lifetime earnings potential what you're making now, and what you expect to gain in the future.

One method to do that is to search for business with solid Economic toughness rankings. the combination of whole life and term insurance is referred to as a family income policy. 8A business that underwrites its very own plans: Some firms can sell policies from an additional insurance firm, and this can add an extra layer if you wish to alter your plan or later on when your family requires a payout

A Term Life Insurance Policy Matures

Some firms use this on a year-to-year basis and while you can expect your rates to climb significantly, it might be worth it for your survivors. An additional means to compare insurance provider is by taking a look at on the internet customer evaluations. While these aren't likely to inform you much about a firm's financial security, it can inform you how simple they are to work with, and whether claims servicing is an issue.

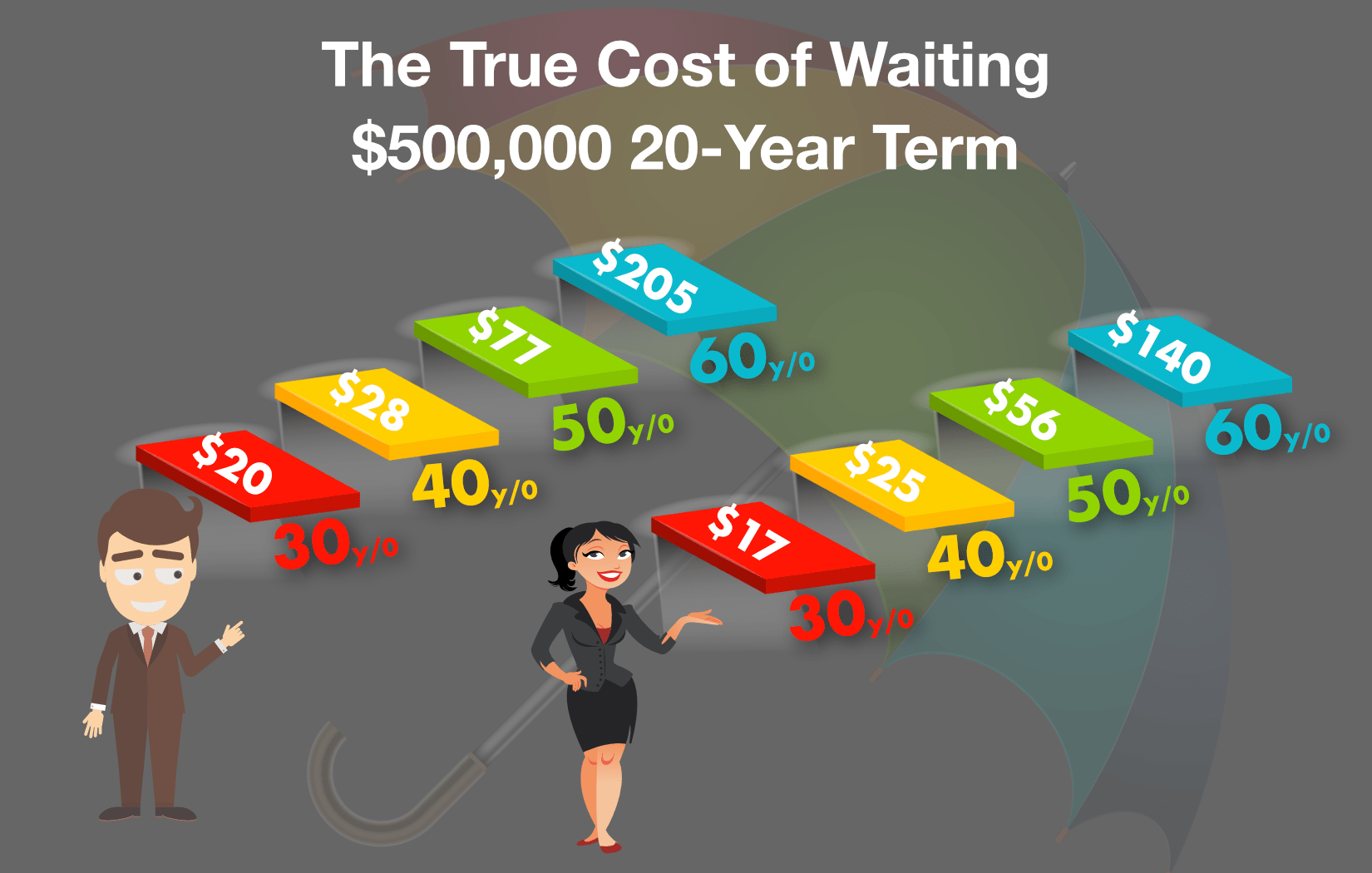

When you're younger, term life insurance can be a straightforward means to safeguard your loved ones. As life modifications your economic concerns can too, so you may want to have whole life insurance policy for its lifetime coverage and extra benefits that you can utilize while you're living.

Approval is ensured no matter your wellness. The premiums won't boost once they're set, yet they will certainly go up with age, so it's a great concept to secure them in early. Figure out more concerning just how a term conversion works.

1Term life insurance policy uses momentary defense for an essential duration of time and is usually less costly than long-term life insurance. when does a term life insurance policy matures. 2Term conversion guidelines and constraints, such as timing, might use; for instance, there might be a ten-year conversion opportunity for some items and a five-year conversion opportunity for others

3Rider Insured's Paid-Up Insurance coverage Acquisition Alternative in New York. There is a cost to exercise this motorcyclist. Not all participating plan owners are qualified for returns.

Latest Posts

What Is Supplemental Term Life Insurance

The Combination Of Whole Life And Blank Term Insurance Is Referred To As A Family Income Policy

What Is A Direct Term Life Insurance Policy